You could review these firms based on customer reviews, economic strength rankings and the kinds of coverage offered. You can even phone a representative to obtain a far better sense of the customer care. Some companies have on the internet quote tools, and others require you to call an agent. You will require to give information concerning your company, including what the business does, how long it's been around as well as what your firm vehicles are made use of for.

Along with the make, design and year, you could likewise need to divulge info like the vehicle's original price, the weight as well as size, just how much staff members typically drive and who the main vehicle driver of the vehicle is. Next, be prepared to offer some information concerning individuals that drive the lorries - automobile.

Often asked inquiries, What is the ideal car insurance coverage business? The finest automobile insurance policy business is various for everybody.

Usually, the fewer vehicle drivers you need to guarantee, the cheaper your policy will certainly be. How can I save cash on commercial insurance coverage? You may be able to save cash on your business auto insurance coverage in a few ways. Initially, make certain to look around and Check over here also get quotes from several suppliers prior to you acquire a policy.

Key Takeaways You might require a business vehicle insurance plan to cover your auto or truck if you utilize it for work, even if you only use it for company component of the time. Commercial car insurance covers your automobile or vehicle and also can be extended to cover your employees, also when they're driving their very own vehicles.

Rumored Buzz on Commercial Auto Insurance For Small Business - Coverwallet

These policies will not cover damage to your own car if you don't have a business policy with extensive and collision defense. What does commercial automobile insurance price? Like routine vehicle insurance policy, the price of coverage for business vehicles relies on a variety of variables, including the age of you or your chauffeurs, mishap background, as well as area.

Generally, it's more expensive to obtain commercial vehicle insurance coverage than it is to guarantee a personal car.

You would obtain a refund in case you transformed to commercial automobile insurance policy in the middle of your policy, as long as your new price isn't above your old rate - business insurance. Can you get one-day company insurance for an auto? Insurance protection can be found in six-month or 12-month terms.

Other than covering cars owned by your company, commercial auto insurance policy likewise covers leased or borrowed vehicles in addition to staff members who utilize their cars for business. vehicle insurance. Covered in business auto insurance coverage are the following: This pays for the repair service and also substitute of automobiles or various other property associated with an accident shown to be brought on by your insured chauffeur.

If your staff member is shown to be the at-fault vehicle driver in a crash, this sort of coverage will certainly pay for the 3rd event's shed wages in addition to clinical and also funeral expenditures. This responsibility will certainly also carry protection costs for your worker when the case goes to court. If you, your workers, or any one of your guests in a commercial automobile have been involved in a crash triggered by an insured or underinsured vehicle driver, UM protection will certainly pay for the damages.

Commercial Auto And Fleet - Liberty Mutual Business Insurance Things To Know Before You Buy

No matter of who's at fault, this kind of coverage pays for the clinical costs you, your workers, and your travelers have incurred as a result of the mishap. This spends for the problems your industrial car sustained during a mishap, regardless of that's at mistake. This relates to when you were hit by an additional vehicle, you hit another lorry, a things hits your automobile or the other way around, or if your car rolls over.

This will likewise pay for your substitute automobile if it's stolen or unrecovered - affordable auto insurance. In the occasion your industrial car requires to get roadside solutions such as towing or gas, this kind of coverage conserves you the difficulty of paying for them. This covers a vehicle you have actually rented out that became involved in an accident.

Getting a business vehicle insurance policy quote from a trusted insurance firm can offer you an idea of just how much you require to spend for the insurance coverage you want. Ordinary Industrial Auto Insurance Coverage Expense Based on Vehicle Kind Businesses are diverse and also make use of different cars for different objectives, so the costs can be dramatically impacted by the type of industrial automobile you intend to guarantee. liability.

These can consist of the following: Refer to exactly how the car is being used, such as for transport or shipment. This involves just how much is required to fix the car when it's damaged. The bigger the vehicle, the greater the insurance cost, as it can create more damages in an accident.

The nature of your organization will certainly also impact the expenses, as some tasks are riskier than others - trucks. A truck doing long-haul deliveries is much more at risk compared to a van that transfers employees within the area of an airport terminal. The automobile type as well as its age are considered when calculating for the ideal insurance cost.

The Best Guide To How Much Does Commercial Auto Insurance Cost – Nationwide

Of training course, the extra business cars you wish to have covered, the greater the cost. If you've submitted various insurance claims in the past, the cost of your insurance is also most likely to boost. Cutting Down on Commercial Auto Insurance Coverage Costs Also though commercial auto insurance policy is a needed cost to keep your organization covered, there are a number of methods you can reduce the settlements for costs.

By doing this, you can be sure that you and your staff members are secured when you obtain involved in a vehicular mishap.

Employing secure vehicle drivers and complying with these motorist screening suggestions can help in reducing organization responsibility in situation of a mishap. Discover an Agent Required a Representative? Obtain the personal service as well as interest that an agent provides. Find a local agent in your location: Travelers Roadside Help Coverage The road is an unsure place.

auto insurance car cheapest auto insurance laws

auto insurance car cheapest auto insurance laws

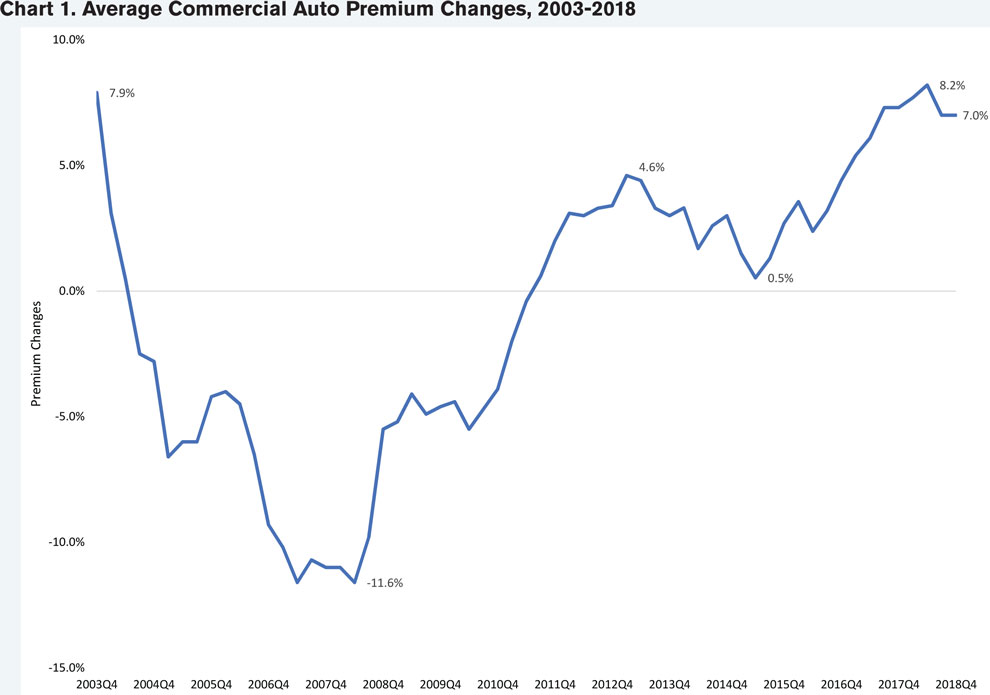

Variables varying from the surge in lawyer representation in physical injury asserts to the higher expenses of substitute parts for technically intricate autos and also trucks remain to increase case prices for insurance policy providers.

Your industrial car insurance coverage expense will depend upon elements like the kind of car, exactly how it's used, and the driving records of the individuals who will run it, to call just a few. Bi, BERK is able to supply insurance policy at up to 20% less than various other insurance coverage companies.

Our Commercial Auto Insurance Quote Diaries

The price to insure vehicles for for-hire trucking can be $5,000 to $15,000 per car per year. Livery automobiles might cost $2,000 to $6,000 per lorry annually to guarantee. insurance affordable.

That has the vehicle? Your automobile will certainly more than likely need business car insurance if it's possessed by a company, however if you're the single proprietor, you may only require an individual car insurance policy. As an example, if you just utilize your automobile just for commuting to as well as from work, you could be covered by your personal vehicle insurance coverage policy - cheap insurance.

Other aspects that are thought about include: Expense brand-new or MSRP of the vehicle Kind or body style of the car What industry your company is in as well as just how the car is utilized Where you drive the vehicle Where the vehicle is garaged throughout the night or non-work hrs Limits, protections and also deductibles Threat is vital a crucial variable to take into consideration - affordable auto insurance.

She may worry that she won't be able to pay for the prompt repair work costs. Her agent advises her that her business car insurance coverage will certainly give coverage for the resulting costs. The plan covers building damage created to the insured's covered car, in addition to 3rd party's in instance of a crash.

That includes individual injury security. A commercial vehicle insurance policy pays when the insurance holder meets with a mishap and receives injuries due to the mistake of a person who does not have insurance coverage.

An Unbiased View of Commercial Auto Insurance

Hit-and-run chauffeurs are also considered as without insurance motorists (car insurance).

business insurance cheap cheap car vehicle insurance

business insurance cheap cheap car vehicle insurance

car affordable auto insurance affordable affordable car insurance

car affordable auto insurance affordable affordable car insurance

car cheapest car insurance car insured low-cost auto insurance

If you're an entrepreneur or contractor, you require to purchase commercial vehicle insurance. It may be appealing to cut prices by getting by on your personal automobile insurance coverage, however in instance of a crash, the unique coverage that service automobile insurance coverage affords could indicate the difference between the life and fatality of your organization - liability.

This covers the damage to a third-party's vehicle (fixing or replacement).: This is coverage that will certainly pay for medical expenditures as well as lost earnings for you (the insured) and your travelers hurt in an accident. PIP pays whether you are at fault. Comprehensive covers repair services to or substitute of your car if it is harmed as a result of the weather, criminal damage, or theft.

Accident insurance will certainly cover the damages that is done to the insurance policy holder's auto as long as the policyholder is at mistake (cheap auto insurance). If an additional party wreckages your vehicle, their obligation spends for repairs.: Uninsured as well as Underinsured coverage is needed by a lot of states as well as will certainly cover you if the other event is liable and also they do not have coverage.

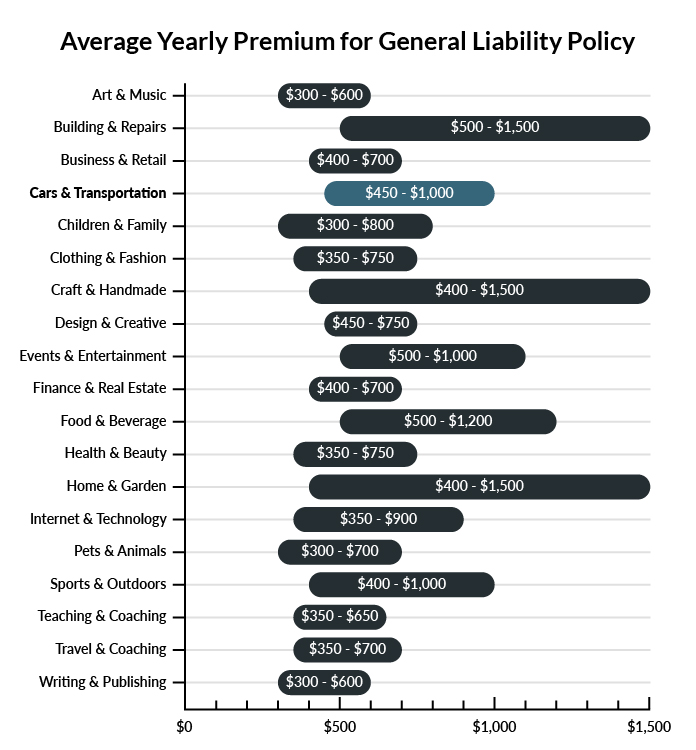

Generally, the yearly expense can be between $750 to $3,000 per automobile. It depends upon the kind of vehicle, the market you remain in, the plans you're adding, deductibles, insurance coverage restrictions, as well as even the insurer you pick. Did you recognize that men under the age of 25 often tend to have the highest possible auto insurance policy prices? Also your marriage standing can influence the price of protection.

About Commercial Auto Insurance - Get A Free Quote - Geico

What is commercial auto insurance? Business automobile insurance policy is a type of car insurance that consists of special coverages made for commercial usage. While much of the coverages consisted of in commercial vehicle insurance resemble the protections in an individual plan, the insurance coverage limits are usually much greater to accommodate the higher legal risks often related to capitalism. affordable car insurance.

This insurance policy will cover you as you drive to as well as from job, as well as on your lunch break. If you are driving while on the clock, your individual policy will not apply. If you obtain in an accident while driving at work, you won't have any type of insurance coverage unless you have business vehicle insurance coverage.

Business vehicle insurance coverage likewise offers non-owner lorry protection. Individual automobile insurance policy, Required for individual driving, Needed for work-related driving, Reduced coverage restrictions, Higher coverage limitations, Normally no protection for equipment, Coverage for materials and equipment Insurance coverage for various other cars and trucks as well as vehicle drivers might be left out Consists of minimal coverage for non-owned lorries and also other chauffeurs, Who requires commercial car insurance policy?

If you ever have employees that drive a vehicle had by your company or you, their individual car insurance will NOT cover themit has to be insured by you. There are additionally distinctions in the amount of automobiles you can put on a personal policy versus a business plan. What does commercial auto insurance cover? Industrial car insurance policy consists of most of the same common coverages as individual automobile insurance.